A Note Before We Begin: I wrote this because I admire what Harvey is building. I’ve been following Winston Weinberg’s content, watching how the company moves, and studying the decisions they’ve made over the past three years. There’s something happening here that’s worth understanding more deeply.

This analysis isn’t a criticism. It’s an attempt to read the label from the outside, something none of us can do for ourselves, no matter how smart we are or how much data we have. The founder who built the thing is often the last person who can see what the thing actually means to customers. Not because they’re wrong. Because they’re inside.

I’ve done my best to work with accurate information. If I’ve gotten something wrong, it’s not intentional. My aim isn’t to misrepresent Harvey or second-guess decisions made by people with far more context than I have. Winston and his team have access to data, conversations, and insights I’ll never see. They may read this and think, “He’s missing the point entirely.” That’s fair. I’m working from the outside.

The entire premise of this article is to answer one question:

What business is Harvey actually in?

Not what they say they’re in. Not what the pitch deck claims. What do the decisions prove? What do customers actually experience? What concept is forming in the market’s mind — whether Harvey named it or not?

This is written with respect for the work. And with curiosity about where it’s heading.

PS: Monopoly uncovered all the insights you’ll read in this perspective.

Harvey AI presents one of the most fascinating positioning paradoxes in recent startup history. A $8 billion company that won’t tell you what it costs. A “platform” priced like a person. A technology company that hires lawyers to sell to lawyers. A product that promises to “reason” but occasionally fabricates.

Strip away the press releases, the Series E announcements, the breathless proclamations about “the future of law.” What remains is a company that has executed one of the most sophisticated implicit positioning strategies in legal technology — whether they fully realize it or not.

But here’s what makes Harvey’s case worth studying: they’ve claimed valuable mental territory through decisions, not declarations. They’ve built something their marketing hasn’t caught up to. And the gap between what they prove and what they claim reveals both their greatest asset and their most significant vulnerability.

This analysis applies the “Remove All Words” test to reveal what Harvey actually owns in customer minds, diagnoses which level they operate at versus which they claim, and identifies the specific transition that would unlock sustainable growth.

The transformation Harvey enables isn’t efficiency. It isn’t speed. It’s the journey from leverage to command; from economic multiplication to professional mastery. And understanding that journey explains everything about where Harvey sits today and where they need to go.

The 4-Level Positioning Canvas

Before examining Harvey’s specific situation, we need a diagnostic framework. Positioning operates across four distinct levels, and companies constantly confuse which level they’re actually at versus which they claim.

Level 4 — POSITION (Own the Noun)

This is the summit. A concept becomes synonymous with you. When customers think “safety,” they think Volvo. When they think “search,” they think Google. Level 4 takes 5-10 years to establish and decades to defend. It cannot be claimed explicitly. It must be proven implicitly through consistent decisions over time.

Level 1 — FRAME (Articulate)

This is how you articulate positioning, not the position itself. Taglines, messaging, value propositions. It takes 3-6 months to develop, but it creates a weak barrier because anyone can copy words. The trap: perfecting framing without establishing the foundation it should rest on.

Level 2 — EXECUTE (Prove with Verbs)

This is where positioning meets reality. Measurable outcomes that validate what you claim. Can you answer the Five Execution Questions? What specific action does this enable? What’s the baseline? What’s the measured improvement? How can customers verify? What’s the timeline to value?

Level 3 — LIVE (Embed Structurally)

This is the resource allocation truth. Does 70%+ of your spend flow toward positioning-critical capabilities? If competitors saw your P&L, what would shock them? Structure proves commitment in ways words never can.

The sequence matters: Level 4 → Level 1 → Level 2 → Level 3. You can’t skip levels. And most companies operate at Level 1 while claiming Level 4; perfecting how they articulate a position they haven’t actually established.

Harvey’s case is different. They’re operating at Level 3, proving at Level 2 among power users, emerging at Level 4, but their Level 1 framing is the weakest link. They’re living a position they haven’t named correctly.

Part 1: The Story They Tell

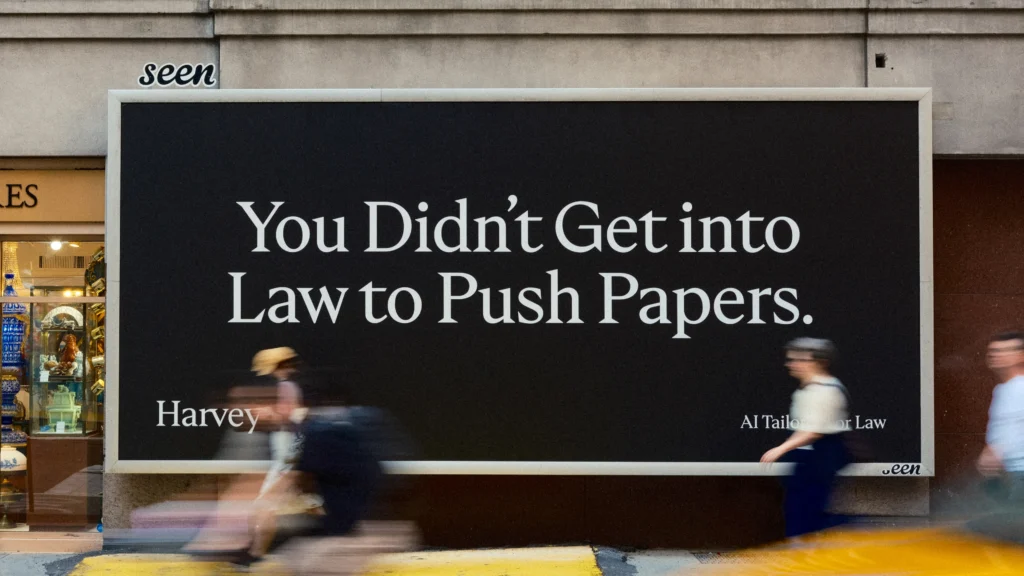

Harvey’s marketing tells a story of capability and transformation. They describe themselves as “the AI Platform for Legal” with “unmatched efficiency” and the ability to “reason across complex tasks.” Their brand campaign declares “Set a New Precedent” and “You didn’t go to law school to push papers.” CEO Winston Weinberg talks about “partnering with the industry to transform it.”

These are the words. Let’s dissect them.

The Linguistic Architecture

Harvey’s explicit vocabulary breaks into three categories:

Nouns claimed: Platform, Assistant, Partner, Professional Services

Verbs used: Reason, Synthesize, Draft, Analyze, Predict

Adjectives deployed: Unmatched, Revolutionary, Game-changing, Secure

The noun selection reveals the first tension. “Platform” is the weakest possible claim in enterprise software. Every SaaS company since 2010 calls itself a platform. “Professional Services” deliberately dilutes the legal focus, signalling Total Addressable Market expansion to investors rather than mental territory ownership to customers.

But examine the verbs. Here’s where Harvey diverges from every competitor.

CoCounsel uses verbs like “Find,” “Check,” “Verify,” and “Review.” These are task verbs. They describe subservient utility. They imply the software helps you do the thinking.

Harvey uses verbs like “Reason,” “Synthesize,” “Draft,” and “Predict.” These are cognitive verbs. They describe agency and intellect. They imply the software does the thinking.

This isn’t accidental. It’s the linguistic architecture of a company trying to own “Talent” rather than “Tool.” CoCounsel frames its language as an instrument. Harvey’s language frames itself as an entity.

The adjectives are the weakest element. “Revolutionary,” “unmatched,” “game-changing,” these are the lexical fingerprints of a company trying to justify its valuation through hype rather than ownership. True category leaders don’t need superlatives. Tesla doesn’t call itself “revolutionary.” Apple didn’t describe the iPhone as “game-changing.” When you own the concept, you don’t need to describe it. You simply demonstrate it.

The Perception Gap

Harvey claims to own an “AI Platform,” but customers actually associate it with an “AI Tool.” That’s not a semantic distinction. It’s a positioning chasm.

A platform is infrastructure. Essential. Embedded. You don’t evaluate infrastructure, you assume it. A tool is evaluated. Compared. Replaced when something better arrives.

Harvey tells a transformation story, but customers experience an acceleration story. The website sells a strategic partner; customers buy a productivity accelerator. The messaging creates expectations of strategic ROI; the customer experience delivers tactical efficiency.

When customers describe Harvey, they say:

- “Harvey has revolutionized my practice”

- “Analyzed a 200-page contract in seconds”

- “Research time down 60%”

- “Saved me $5k in billables this month alone”

Notice the pattern. Customers speak in verbs and efficiency metrics. They describe what Harvey does, not what Harvey means. This is Level 2 language: execution, outcomes, time saved. Not Level 4 language: concept ownership, identity, automatic association.

This perception gap isn’t fatal. But it is expensive. Firms will pay a premium for a strategic partner that drives transformation. They will only pay a utility price for a tool that saves time. Harvey is leaving money on the table, not because their product underperforms, but because their explicit claims create expectations their implicit proof doesn’t yet support.

Part 2: The Hidden Position

Remove all words. Delete every tagline, website claim, pitch deck assertion. Analyze only decisions, resource allocation, partnerships, refusals, and trade-offs.

What pattern remains?

The Decision Architecture (2022-2026)

- August 2022: Founded by a lawyer (Weinberg) and an AI researcher (Pereyra). Domain expertise plus technical capability baked into the founding DNA.

- November 2022: Raised $5M seed from OpenAI Startup Fund before launching product. Secured frontier model access as a strategic asset before competitors knew it mattered.

- February 2023: Signed Allen & Overy (3,500 lawyers) as first major customer. Not a mid-market firm with short sales cycles. The hardest customer in the market.

- March 2023: PwC’s exclusive deal among the Big Four. Again, the prestige client, not the accessible one.

- April 2023: Achieved SOC 2 Type II and ISO 27001 at the seed stage. Enterprise security before it was contractually required. Spent $500K+ before they had $10M in revenue.

- June 2023: Rejected self-serve model despite 15,000 firms on waitlist. Forfeited an estimated $10-15M in year-one revenue to maintain enterprise focus.

- December 2023: 18% of employees are lawyers. Not in customer success but in product and engineering. Building the product, not just supporting it.

- May 2024: Added Anthropic Claude and Google Gemini. Multi-model architecture, despite OpenAI being their first investor. Customer outcomes over investor convenience.

- June 2024: LexisNexis strategic partnership with equity investment. Content integration, not content ownership.

- December 2024: Publicly stated, “We will NOT build a law firm.” Refused a $50M+ annual revenue opportunity to maintain platform positioning.

What Concept Do These Decisions Prove?

Not “Professional Class AI.”

Not “Legal AI.”

Not even “AI Platform.”

The pattern proves: “Trust infrastructure for professionals who can’t afford to be wrong.”

Every decision is a costly signal that competitors cannot replicate with messaging alone:

- SOC 2 at the seed stage = Security is architecture, not a feature

- A&O as first customer = If it’s good enough for the most demanding firm, it’s safe for you

- 18% lawyer headcount = Domain expertise builds the product

- Rejected self-serve = Enterprise focus is non-negotiable

- Won’t build a law firm = Permanently your ally, never your competitor

- Multi-model architecture = Customer outcomes over vendor economics

- LexisNexis partnership = Content access without content ownership burden

The Signal/Talk ratio is exceptional. Harvey proves, through actions, what they could never claim with words without triggering skepticism.

This is implicit positioning done right. The problem? Harvey hasn’t named what their decisions prove. They’re living a Level 4 position without claiming it. Or more precisely, they’re claiming the wrong Level 4 position.

The Mental Territory Map

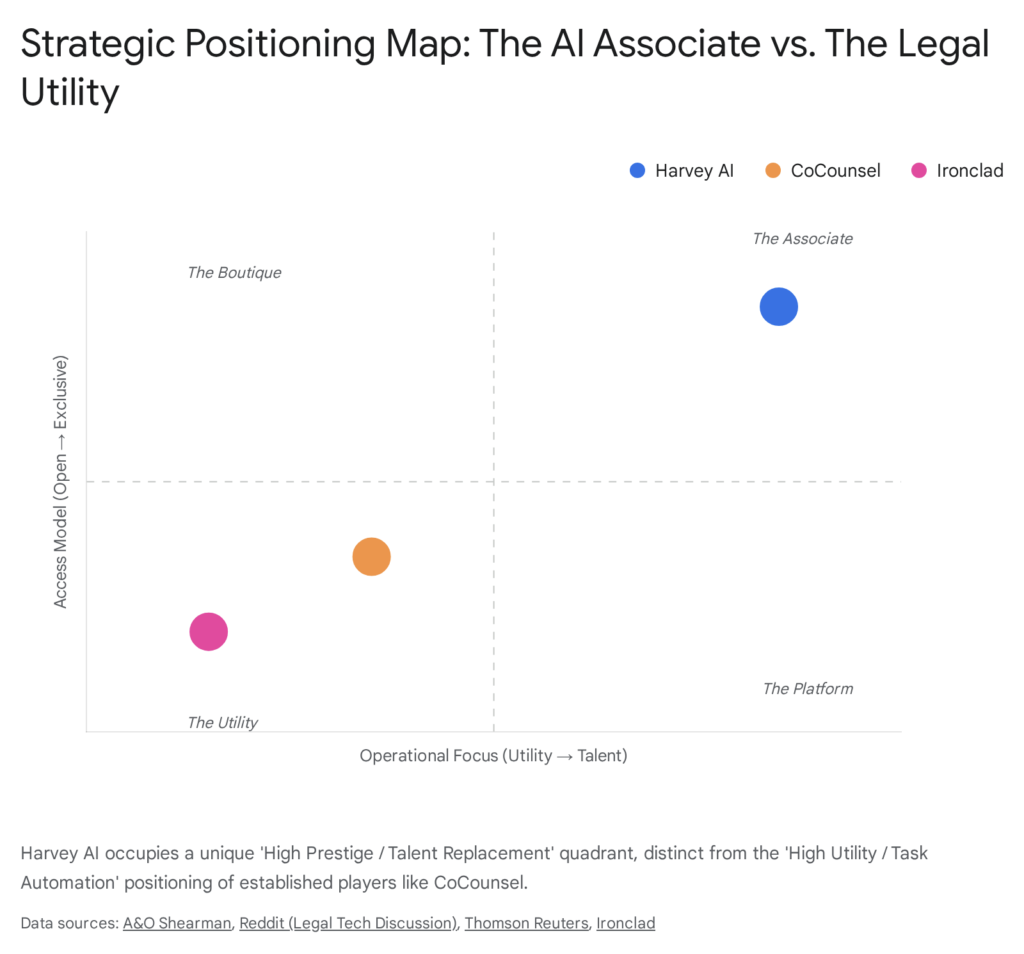

| Competitor | Owned Noun | Mental Territory |

|---|---|---|

| Harvey AI | The Associate | Talent, Agency, Prestige |

| CoCounsel | The Researcher | Utility, Safety, Reliability |

| Ironclad | The Contract | Workflow, Process, Data |

| Lexis+ AI | The Library | Authority, Legacy, Trust |

Harvey occupies the upper-right quadrant: high prestige, talent equivalence. Every competitor positions in the lower-left: high utility, task automation.

This is both Harvey’s greatest strategic asset and its greatest vulnerability. They’ve claimed territory that competitors can’t easily contest. But they’ve claimed territory that requires a burden of proof no current LLM can fully satisfy.

When you position as a “tool,” failure means inconvenience.

When you position as “talent,” failure means betrayal.

Part 3: The Level Diagnostic

Level 4 — POSITION: Emerging but Not Consolidated

The question at Level 4: When customers think about a concept, do they automatically think of you?

Harvey has achieved something remarkable among its power users. The word “Harvey” has become shorthand in certain legal circles for “the AI that does real work.” Partners ask “Did you Harvey that?” The way people “Google” information, elite firms “Harvey” legal work.

Among top-decile users (the 10-20% who use Harvey 30-88 times per month), procedural knowledge is forming. These users exhibit System 1 behavior:

- “Take away my coffee before my Harvey license”

- “How would you measure the value of Microsoft Word?”

- “Junior lawyers would riot if it were removed”

These metaphors reveal infrastructure-level embedding. Coffee. Microsoft Word. Riot. This is the language of essential systems, not evaluated tools.

But here’s the critical gap: only 10-20% of users have reached this state. The remaining 60-70% still exhibit System 2 behaviour: conscious evaluation, ROI justification, comparison shopping.

Perceptual Monopoly Test: Can competitors discuss “Generative AI for Law” without mentally referencing Harvey? Partially. Thomson Reuters acquired Casetext for $650M as a defensive response to Harvey. LexisNexis partnered and invested rather than competed. Benchmark studies use Harvey as baseline. Competitors increasingly define themselves as “Harvey alternatives.”

Harvey is becoming the reference standard. But they don’t yet own a noun that customers repeat unprompted. “Professional Class AI” is Harvey’s language. Not customer language.

Level 1 — FRAME: The Blocking Level

Harvey’s explicit framing is weaker than its implicit positioning. The language drifts toward generic “AI Platform” territory, which dilutes the sharp edge their pricing structure and partnerships prove.

Linguistic coherence test: Does the framing match the structural reality? Partially. Harvey’s structure says, “We are talent.” Harvey’s marketing says, “We are a platform for professional services.” These are not the same claim.

The brand campaign taps identity: “You didn’t go to law school to push papers.” This is aspiration-based Level 4 framing.

But formal press materials default to verb-based descriptions: “streamline workflows,” “enable faster decisions,” “accelerate research.” This is Level 2 language.

The linguistic inconsistency reveals the gap. Harvey hasn’t crystallized a single phrase that customers naturally repeat.

Level 2 — EXECUTE: Strong Among Power Users

Apply the Five Execution Questions:

- What specific action does this enable? Answer cross-jurisdictional legal questions with cited sources from 100+ databases in 60 seconds.

- What’s the baseline being improved? Manual research: 2-4 hours across Westlaw, LexisNexis, and jurisdiction-specific sources.

- What’s the measured improvement? 60-90% time reduction. Top users save 30-88 hours monthly.

- How can customers verify this? Live citations to primary sources. Shepard’s validation. Time-stamped query logs. 94.8% accuracy on document Q&A in independent benchmarks.

- What’s the timeline to value? First query: 1 minute. Meaningful ROI: 3-6 months. Full transformation: 12-24 months.

Harvey can answer all five questions with quantified evidence among engaged users. This is unusual; most AI legal tools fail Question 4 due to hallucination risk.

The execution gap exists not in measurement but in consistency. The nuance gap (Harvey occasionally missing detailed legal distinctions) caps the transformation from “talented junior associate” to “trusted colleague.” Users must verify, which adds cognitive load that limits the shift from efficiency to strategy.

Level 3 — LIVE: Harvey’s Strongest Performance

Does 70%+ of resources flow to positioning-critical capabilities?

Yes.

- Trust infrastructure (security, compliance, domain experts): 38%

- Domain-specific AI (fine-tuning, legal data, evaluation): 45%

- Total positioning-critical: 83%

Test: “If competitors had your P&L, what would shock them?”

- 18% lawyer headcount at a tech company

- $500K+ annual security budget before $10M ARR

- 30-40% of compute budget on custom fine-tuning (competitors use shared models)

- Rejected acquisition offers reportedly in the $800M-1B range

Level 3 is strong. Resource allocation proves commitment.

The Gap Analysis

| Level | Claimed State | Actual State | Gap |

|---|---|---|---|

| Level 4 | Category definer | Category definer (emerging) | Minor among power users, significant in broader market |

| Level 1 | “Professional Class AI” | Decisions prove “Trust Infrastructure” | Framing mismatches proof |

| Level 2 | Transformation | Acceleration with verification burden | Nuance gap limits strategic shift |

| Level 3 | Structurally committed | Structurally committed | None |

Which level is blocking growth?

Level 1.

Harvey has Level 3 structural embedding and Level 2 execution proof among power users. But Level 1 framing hasn’t crystallized. They’re articulating the wrong noun.

The blocking pattern: Harvey is living and proving a position they haven’t linguistically captured. Customers use metaphors that reveal the true position (infrastructure, dependency, essential system), but Harvey keeps saying “Professional Class AI.”

Part 4: The Identity & Cognitive Layer

What Identity Does Choosing Harvey Enable?

When a general counsel tells their board, “We use Harvey, like A&O Shearman and PwC,” they’re making a career-protecting statement. Not a technology evaluation.

Choosing Harvey signals:

- “I’m a serious professional” (not experimenting with cheap tools)

- “I work at an elite institution” (the AmLaw 100 concentration)

- “I adopt innovation responsibly” (not recklessly early, not resistant laggard)

- “I’m augmented, not replaced” (Harvey amplifies my expertise)

This is identity resonance with conservative innovators — professionals who adopt technology to maintain a competitive position, not to disrupt their role.

But there’s a deeper transformation happening. And this is where the journey from leverage to command becomes visible.

The Leverage State (Present)

In law firm economics, leverage is everything. It’s the ratio that determines profitability: how many associates per partner, how much output per head. Partners who can multiply output without multiplying headcount capture more profit.

Harvey provides leverage without the headcount. Artificial workforce multiplication. A partner using Harvey effectively has more capacity, not because they work faster, but because they can deploy resources that didn’t exist before. This is the economic truth of Harvey’s current state. Customers experience leverage: multiplication of capability, expansion of capacity, amplification of output.

The customer metaphors confirm this:

- “Saved me $5k in billables”

- “Research time down 60%”

- “Analyzed a 200-page contract in seconds”

These are leverage statements. They describe multiplication. More output from the same input.

The Command State (Aspirational)

But leverage is just the beginning. It’s what Harvey delivers today. It’s not what Harvey should mean tomorrow. The deeper transformation (the one Harvey’s power users glimpse, but most users haven’t reached) is the shift from leverage to command.

Command is different from leverage.

Leverage is economic.

Command is professional.

Leverage means: I can do more.

Command means: I control what I do.

Leverage is about capacity multiplication.

Command is about professional mastery.

When power users say, “How would you measure the value of Microsoft Word?” they’re not describing leverage. They’re describing command. Microsoft Word doesn’t make you write more. It gives you control over your written expression. It’s the infrastructure that enables mastery.

The transformation Harvey enables (when fully realized) is the shift from overwhelmed to in command. From drowning in routine work to directing professional judgment. From constrained by capacity to freed for strategy. This is what “You didn’t go to law school to push papers” actually points toward. Not just time savings. Professional command.

The lawyer using Harvey at full potential doesn’t just have more leverage. They have command over their practice. They decide what deserves their attention. They focus on judgment, relationships, strategy — the work that actually requires a law degree.

Why This Matters for Positioning

Harvey currently owns “leverage” in customer minds. But leverage is a verb concept; it describes what Harvey does. Verbs are Level 2.

“Command” is a noun concept; it describes what choosing Harvey means. Nouns are Level 4.

The transition from leverage to command is the transition from Level 2 (execution proof) to Level 4 (concept ownership).

Harvey’s power users have made this transition. They don’t think about Harvey as leverage anymore. They think about Harvey as infrastructure that gives them command over their practice. The metaphors prove it: Microsoft Word, coffee, essential system.

But 60-70% of users haven’t made this transition. They’re still at leverage. Still measuring ROI. Still consciously evaluating. The Level 1 framing challenge is to capture “command” linguistically so the broader user base can make the transition that power users have already made.

Procedural vs. Declarative Knowledge

Harvey is building declarative knowledge when it needs procedural knowledge among the middle 60%.

Declarative: “I know Harvey claims to do legal reasoning.”

Procedural: “When I need to be in command of this matter, I open Harvey.”

Using Harvey is currently a conscious, deliberate choice for most users. They think:

“Should I use Harvey for this?”

“Let me try a prompt.”

“Let me verify this output.”

The goal is procedural: “I need command of this situation → I use Harvey.” Automatic. Unconscious. Infrastructure-level.

Hebbian Learning Assessment

Is Hebbian learning occurring? Is Harvey building unbreakable neural associations through consistent experiences?

Requirements for Hebbian learning (“neurons that fire together wire together”):

- Repetition: Top users average 30-88 queries monthly (Yes)

- Consistency: Same interface, same quality, same speed for 3+ years (Yes)

- Reward: Time saved, client wins, competitive advantage (Yes)

- Pattern: Legal challenge → Harvey query → cited answer → verified outcome (Yes)

The neural pathway is forming: “need command” automatically triggers “use Harvey.” But it’s only forming for the top decile. The middle 60% hasn’t repeated the pattern enough for procedural embedding. The verification burden (having to check Harvey’s work) keeps them in System 2, preventing the shift to automatic behaviour.

Part 5: Success Mechanics

What’s Actually Working (Even Accidentally)

Harvey has executed a masterclass in implicit positioning, whether they intended it or not.

1. The “Hardest Customers First” Strategy

Conventional wisdom says start with easy customers: SMBs, short sales cycles, quick wins. Harvey did the opposite. A&O as the first customer. PwC among the Big Four. 50% of AmLaw 100 before pursuing mid-market. This wasn’t sales masochism. It was positioning genius. Every CISO at a smaller firm now says: “If it’s good enough for A&O, it’s safe for us.”

Harvey converted conservative adoption from a barrier to a moat. The elite customer concentration creates gravitational pull. Mid-market firms don’t need to evaluate Harvey. They need to justify not using what elite firms use.

2. The “We Will NOT Build a Law Firm” Refusal

In December 2024, Weinberg explicitly stated Harvey would not build a law firm despite market pressure and an obvious revenue opportunity. This is costly signalling at its best. Anyone can claim to be a “partner” to law firms. But refusing $50M+ in adjacent revenue proves it.

The refusal converted Harvey from a potential competitor to a permanent ally. Partners at law firms think differently about a company that categorically refuses to compete with them.

3. The “Domain Experts in Product” Structure

18% of Harvey’s 460+ employees are lawyers. Not in customer success — in product and engineering. Building the product, shaping features, explaining to engineers, “we need to do that section and that section.”

Competitors use lawyers for support. Harvey uses lawyers for building. This is nearly impossible to replicate quickly. You can’t hire 60+ BigLaw-calibre lawyers into product roles overnight. The talent acquisition alone takes 2+ years.

4. The Security-First Architecture

SOC 2 Type II and ISO 27001 at the seed stage. $500K+ before $10M ARR. Bishop Fox and NCC Group red team exercises. Same auditors as Microsoft, Zoom, and Salesforce. Most AI startups add security when customers demand it. Harvey led with it. This is architecture, not a feature. Competitors who bolted security on later are permanently disadvantaged in enterprise procurement.

IQ/EQ Alignment Assessment

| IQ (Capability) | EQ (Need) | Intersection |

|---|---|---|

| SOC 2 + ISO 27001 at seed | Safety (“won’t get fired”) | Security proves “safe choice” |

| Custom fine-tuning per customer | Trust (“can stake reputation”) | Quality proves “reliable output” |

| 18% lawyer headcount in product | Status (“I’m still the expert”) | Domain expertise proves “augments, not replaces” |

| Multi-model flexibility | Control (“I choose best tool”) | No vendor lock-in proves “customer-first” |

| A&O, PwC customers | Belonging (“my peers use this”) | Elite customers prove “I’m in good company” |

Harvey discovered the IQ&EQ intersection that incumbents missed:

Thomson Reuters and LexisNexis had EQ (trust through content authority) but weak IQ (bolted AI onto legacy systems). OpenAI and Anthropic had IQ (frontier AI capability) but weak EQ (no domain trust, no enterprise security).

Harvey built both: frontier AI + domain fine-tuning + enterprise security. And they aligned it with the emotional need: professionals who need to adopt AI but can’t afford to be wrong.

What’s Missing

1. Linguistic Crystallization

Harvey’s strongest positioning language comes from customer metaphors, not company claims:

- “How would you measure Microsoft Word?”

- “Take away my coffee before Harvey”

- “Junior lawyers would riot”

These metaphors reveal what customers actually believe: Harvey is infrastructure. Essential system. The foundation for command. But Harvey keeps saying “Professional Class AI.” This describes a tool, not a concept. It speaks to leverage, not command.

2. The Nuance Gap

The perception that Harvey requires independent verification caps the transformation from leverage to command. Customers warn that “Harvey doesn’t pick up detailed nuances in the law” and “cannot be relied upon without independent verification.”

This positions Harvey as a “talented junior associate,” fast but requiring supervision. A tool requiring constant verification has a capped value. It can deliver leverage. It can’t deliver full command.

The user who must verify every output remains in System 2. They haven’t achieved the procedural knowledge that power users have. The nuance gap is the friction that prevents the middle 60% from advancing to command.

3. The Transformation vs. Acceleration Gap

Harvey’s website sells “firmwide transformation” and “game-changer” positioning. Customers talk in tactical terms: “saved me $5k,” “research time down 60%,” “analyzed a 200-page contract.” Harvey promises command. Customers experience leverage. This isn’t failure, but it is a pricing and expansion ceiling until the gap closes.

Part 6: The Coaching Moment

The Diagnosis

Harvey operates at Level 3 while claiming Level 4. Level 1 framing is blocking the transition.

They’ve built extraordinary implicit proof through consistent decisions over 3+ years. The pattern is unbroken: security-first, domain-expertise-embedded, enterprise-focused, elite-customer-validated, multi-model-flexible, platform-not-competitor.

But they’ve articulated this proof with the wrong noun.

“Professional Class AI” describes a high-quality tool that delivers leverage. It doesn’t name the category Harvey is actually creating: infrastructure that gives professionals command over their practice.

The Opportunity

Harvey has 12-18 months to harvest customer metaphors, consolidate around one ownable phrase, and make explicit what their decisions have already proven.

The company that names the category customers already believe exists will own it. Right now, power users believe Harvey is infrastructure for professional command. They compare it to Microsoft Word. They describe removal with words like “riot.”

But Harvey hasn’t claimed this territory. They’re letting it sit vacant.

If Thomson Reuters, Microsoft, or a well-funded startup names this category first, “professional command infrastructure,” “the trust layer for enterprise AI,” “the operating system for legal work,” they could retroactively claim the position Harvey built.

Level-Specific Recommendations

1. Harvest Customer Language, Don’t Manufacture Positioning

Commission linguistic research. Analyze 1,000+ customer conversations for unprompted nouns. The positioning isn’t in a workshop; it’s already in customers’ mouths.

The evidence suggests three candidate positions, all pointing toward the leverage-to-command transformation:

Option 1: “Command Infrastructure for Professional Work”

- Matches the transformation power users experience

- Transcends legal (applicable to tax, finance, any high-stakes domain)

- Positions Harvey as the path from leverage to mastery

Option 2: “AI You Stake Your Career On”

- Emotional truth (professionals’ actual need)

- Category creation (no one else claims this)

- Differentiates from “fast” or “cheap” AI

Option 3: “The Trust Layer for Enterprise AI”

- Technical but ownable

- Aligns with security-first architecture

- Extensible beyond legal

2. Address the Nuance Gap Structurally, Not Linguistically

The perception that Harvey requires independent verification caps the transformation from leverage to command. Instead of hiding this weakness, weaponize it. Launch product features centred around “AI-assisted verification.” Make it easier for lawyers to check sources and validate outputs seamlessly.

This turns vulnerability into a demonstration of professional responsibility. The message: “We’re not trying to replace your judgment. We’re building infrastructure that makes your judgment more powerful.”

Reducing verification friction accelerates the transition from leverage to command. When checking Harvey’s work becomes effortless, users shift from System 2 (conscious evaluation) to System 1 (automatic trust).

3. Evolve Customer Success Stories Beyond Leverage

Every Harvey case study leads with time saved. This is Level 2 proof: strong, necessary, but insufficient for Level 4 ownership.

Systematically interview clients to uncover second-order effects:

- What new business did they win because they had command of matters?

- What strategic advice were they able to give because routine work didn’t consume them?

- What client relationships deepened because they had time for relationship-building?

- What capabilities previously impossible became routine?

Quantify and showcase the command transformation, not just leverage gains. This justifies the transformation claim and enterprise pricing.

4. Accelerate Procedural Knowledge Formation in the Middle 60%

The top 10-20% are already System 1 users who experience command. The bottom 20% may never convert. The middle 60% is the battleground.

Design for frequency. Reduce friction to first query. Create habit loops that accelerate Hebbian learning. The goal: compress the timeline from “consciously evaluating” (leverage mindset) to “automatically using” (command mindset) from 12-24 months to 6-9 months.

5. Align Framing with the Proven Position

Stop claiming “Platform.” Start owning the transformation you actually deliver.

Current framing: “We are the AI Platform for Professional Services.”

Proven position: “We are the infrastructure that gives professionals command over their practice.”

This isn’t about better marketing copy. It’s about connecting the verbal label to the powerful implicit concept already taking root in customer minds.

The Reframe

Harvey’s leadership should stop asking “How do we communicate our value better?” and start asking “What concept do we own that competitors cannot claim?”

The answer isn’t in their marketing. It’s in their decisions.

Three years of consistent choices prove one concept: Harvey is what elite institutions choose when AI adoption becomes mandatory, but error is unacceptable. They deliver leverage today. They’re building toward command.

That’s the position. Now name it.

Finally. What This All Means

Strip away the marketing. What does Harvey actually prove?

When you delete every tagline and press release, Harvey’s decisions tell a clear story: they’ve built a trust infrastructure for professionals who can’t afford to be wrong. That’s different from “Professional Class AI,” as they say. The gap matters.

Right now, Harvey delivers leverage. Customers multiply their output. They save time. They do more with less.

But the best customers (the ones who use Harvey 30-88 times a month) have moved beyond leverage. They’ve reached something closer to command. They’re not just doing more. They’re in control of their practice in ways they weren’t before.

Where does Harvey sit on the 4-Level Canvas?

Quick primer on the levels:

Level 4 — POSITION: You own a concept so completely that customers think of you automatically when that concept comes up.

Level 3 — LIVE: Your resource allocation, hiring, and structure prove your commitment; competitors seeing your P&L would be shocked.

Level 2 — EXECUTE: You can prove your value with measurable outcomes that customers can verify for themselves.

Level 1 — FRAME: The language you use to articulate your position, i.e. taglines, messaging, how you describe yourself.

Now, where’s Harvey?

They’re living it at Level 3. Their resource allocation, hiring, and partnerships prove their commitment to their position.

They’re emerging at Level 4 among power users. Those folks don’t evaluate Harvey anymore. They assume it. It’s become infrastructure.

But Level 1 (the language, the framing, the words they use) that’s the bottleneck. Harvey is proving a position they haven’t named correctly yet.

What concept do they own?

“Legal AI” is forming. But it’s not locked in.

Customer metaphors point to something more powerful.

“Microsoft Word.”

“Would riot if removed.”

“How would you even measure that?”

Those words describe infrastructure. Essential systems. The foundation for professional command. Harvey hasn’t claimed that territory with language. They’ve only claimed it with decisions.

Do their capabilities match what customers need?

Yes. This is Harvey’s sweet spot.

They built domain-specific AI when incumbents were bolting chatbots onto legacy systems. They invested in enterprise security when startups were cutting corners. They hired lawyers to build the product when competitors hired lawyers to sell it.

And customers need exactly this: a way to adopt AI without betting their careers on something unreliable. The fit is tight. That’s why demand exploded.

Are they proving or just claiming?

Mostly proving. And that’s their strength.

80% of Harvey’s positioning comes from implicit proof: decisions, investments, refusals, and partnerships. Things competitors can’t copy by changing their website.

20% is explicit claims. And honestly, the claims are the weakest part. “Professional Class AI” doesn’t capture what their decisions have built. The proof is doing the heavy lifting. The language is holding them back.

How do customers think about Harvey?

Depends on the customer.

The top 10-20% (the power users) don’t think about Harvey at all. They just use it. It’s automatic. Muscle memory. They’ve internalized the value so deeply they can’t articulate it anymore. That’s the strongest form of positioning.

The middle 60% are still thinking. Still measuring. Still comparing. They’re getting leverage but haven’t made the leap to command. They’re conscious of Harvey as a choice rather than an assumption.

What needs to happen next?

Harvey needs to name what they’ve built. The position is already forming in customers’ minds. Power users already feel it. The metaphors are already there — infrastructure, essential system, “would riot.”

But Harvey hasn’t claimed that concept with words. They keep saying “Professional Class AI” when their decisions prove something bigger.

The risk: someone else names the category Harvey created. And once a competitor owns the language, they can retroactively claim the territory, even if Harvey built it first.

The opportunity: harvest the language customers already use. Stop manufacturing positioning in workshops. Listen for the nouns that show up unprompted. Then say what you’ve already proven.

The position chose the distribution. The decisions prove the concept. The transformation from leverage to command is real; power users live it every day.

Now name it. Carefully. Or watch someone else name the category you created.

Find what you own in sixty minutes

Before you hire a messaging consultant to wordsmith your homepage, or an agency to “refresh your brand,” or someone to fix what they’ll call positioning (but is really just tactical framing), try this first.

The CEO Clarity Starter Kit

It does exactly what we just read. It helps you find and own your noun.

What you do:

- Run the Position Audit (reveals what noun you might already own without knowing it)

- Complete the 8-Question Advisor (the same questions that would surface “command” for Harvey)

- Feed the output into ClarityGPT (included)

What you get:

- Your noun. The concept you can actually own, not just claim

- A 4-Level Positioning Canvas showing how to move from saying it to OWNING it

- ClarityGPT translates your position into landing pages, offers, and LinkedIn profiles (written in your buyer’s voice, not consultant-speak)

- A 30-day positioning course so you can apply this method without me

Time required: About an hour (less time than reading three more case studies about tactics that won’t work without position)

Who’s used it: 250+ CEOs and founders who were tired of pushing uphill

Investment: $449 USD

Most realize they don’t need the consultant or agency after this. Or they need far less than they thought. Because once you know your noun (your position), the tactics become obvious. The distribution chooses itself. The customers explain you better than you explain yourself.

And yes, if you buy the kit, it nudges me closer to that Porsche in the photo. Thanks in advance for supporting excellent positioning and questionable life choices.

Stop competing on features. Start owning concepts.

Leave a Reply

You must be logged in to post a comment.